Will The Bitcoin 4-Year Cycle ‘Break’ Under Trump’s Crypto Executive Order? Bitwise CIO Explains

In a recent memo, Bitwise Chief Investment Officer (CIO) Matt Hougan shared his thoughts on the Bitcoin (BTC) 4-year cycle and its relevance under Donald Trump’s administration. Specifically, he examined whether a shift in Washington DC’s stance on cryptocurrencies could extend the current bull market into 2026 and beyond.

Bitcoin 4-Year Cycle Not Driven By Halvings

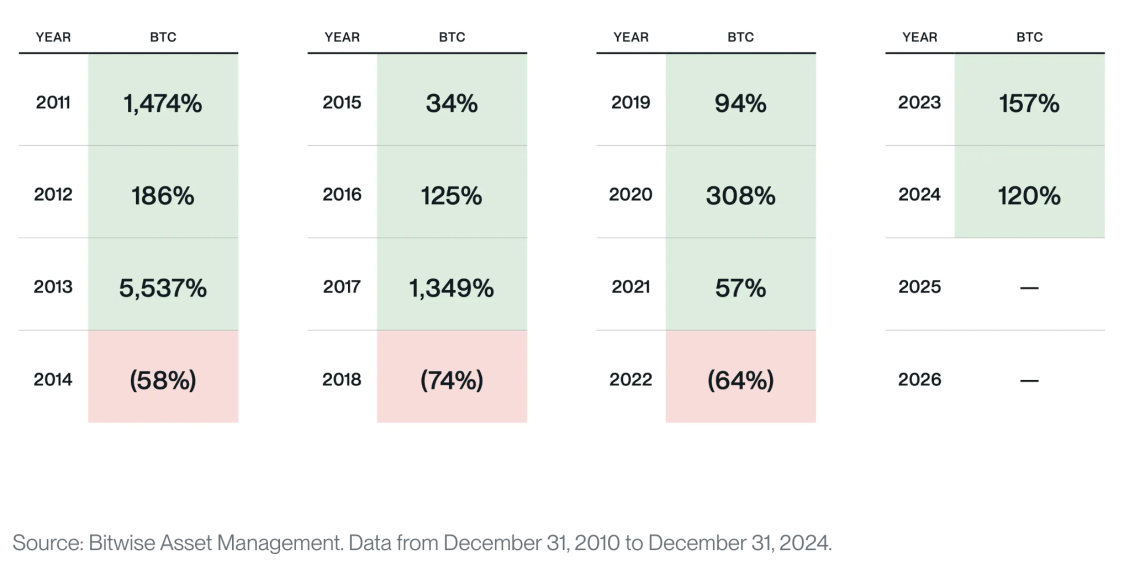

The Bitcoin 4-year cycle refers to the digital asset’s historical price pattern, typically consisting of three years of strong appreciation followed by a year of major pullback across all cryptocurrencies. The following chart provides a clear picture of this cycle.

According to the chart, 2025 should be another year of positive price action for BTC, while 2026 could bring a ‘crypto winter,’ characterized by sustained deleveraging and declining prices across digital assets.

Hougan challenged the common belief that Bitcoin’s 4-year cycle is driven by its halving events. He clarified that BTC’s quadrennial halvings – occurring in 2016, 2020, and 2024 – are not perfectly aligned with the cycle’s peaks and troughs.

As for the current market phase, Hougan reaffirmed Bitwise’s earlier prediction that BTC could double in price this year, surpassing $200,000. He identified the primary catalysts as institutional inflows into crypto exchange-traded funds (ETFs) and increased BTC purchases by corporations and governments.

Market Pullbacks Likely To Be Shallow, Hougan Says

Hougan described Trump’s recently issued crypto executive order (EO) as “overwhelmingly bullish,” emphasizing how it frames the expansion of the US crypto ecosystem as a national priority. The EO also calls for the establishment of a “national crypto stockpile” and lays the groundwork for Wall Street banks and institutional investors to enter the market under favorable regulations. Hougan explained:

In my view, the launch of ETFs was a big enough event to bring hundreds of billions of dollars into the crypto ecosystem from new investors. That was what was driving this cycle. But the full mainstreaming of crypto – the one contemplated by Trump’s executive order, where banks custody crypto alongside other assets, stablecoins are integrated broadly into the global payments ecosystem, and the largest institutions establish positions in crypto – I’m convinced will bring trillions.

Hougan acknowledged that the EO’s full impact will unfold over years rather than months, highlighting key reasons for this gradual progression. First, newly appointed White House crypto czar David Sacks will need time to develop a comprehensive regulatory framework. Second, major Wall Street firms will likely take even longer to fully recognize and integrate crypto’s potential.

In conclusion, Hougan suggested that while the market has not entirely broken free from Bitcoin’s traditional 4-year cycle, any pullbacks will likely be shallower and shorter-lived compared to previous downturns.

Similar to Bitwise’s prediction, Standard Chartered recently forecasted that BTC may surge as high as $200,000 by the end of 2025. At press time, BTC trades at $106,119, up 3.7% in the past 24 hours.

Featured Image from Unsplash.com, Charts from Bitwise and TradingView.com

Source link